如你在香港各大證券行(耀才,富昌, 通海,英皇,鼎展,凱基 等等)有戶口的話, 使可以用Spark軟件, 輕鬆設定用技術指標條件來觸發開盤及平盤.

例如當以下條件成立時, 觸發買一張HSIJ2的交易指示

- EMA(5 x 1分鐘) 升穿 EMA(9 x 1分鐘) 多過5 點 和

- EMA(9 x 1分鐘) 升穿 EMA(15 x 1分鐘) 多過5 點 和

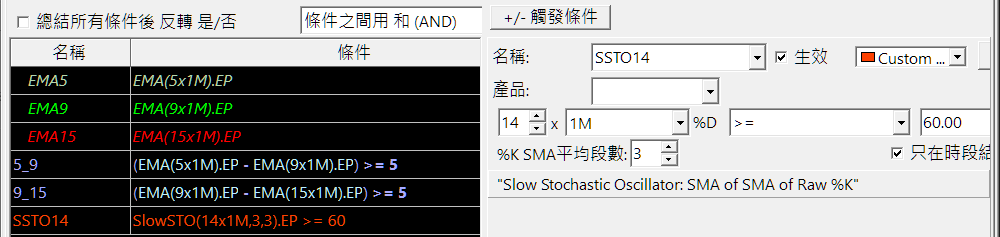

- Slow Stochastic (14 x 1分鐘, 3,3) >= 60

詳細步驟:

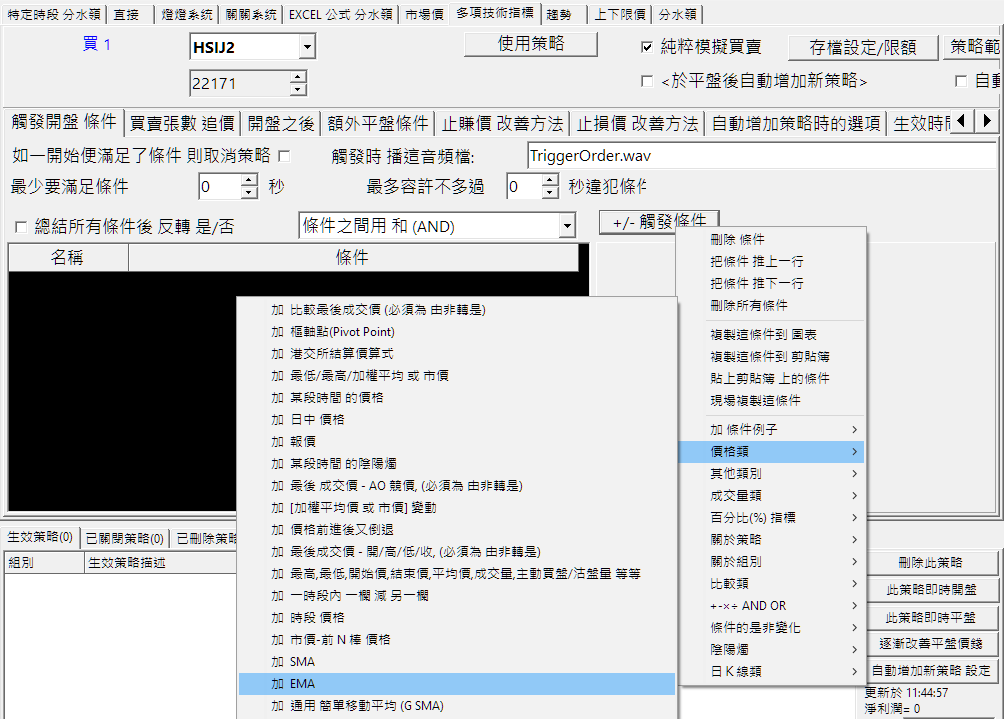

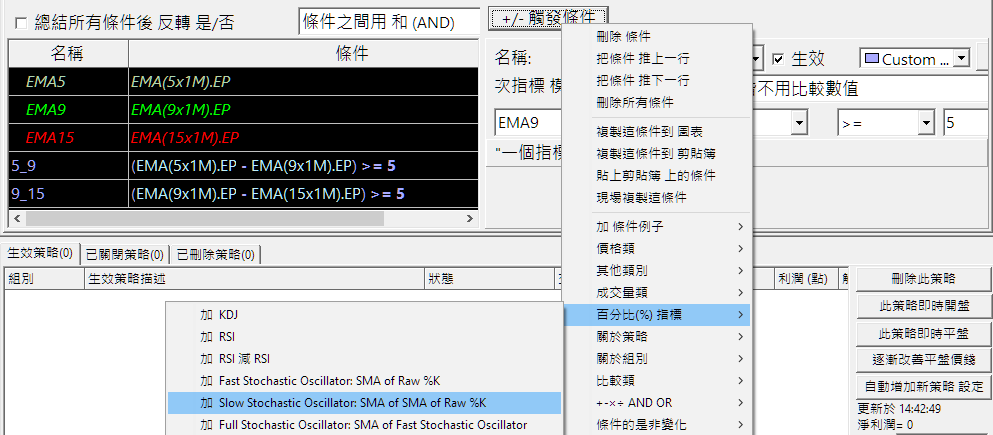

在多項技術分析指標 頁 的 “觸發開盤 條件” 按右邊的 “+/- 觸發條件“, 選 “EMA“

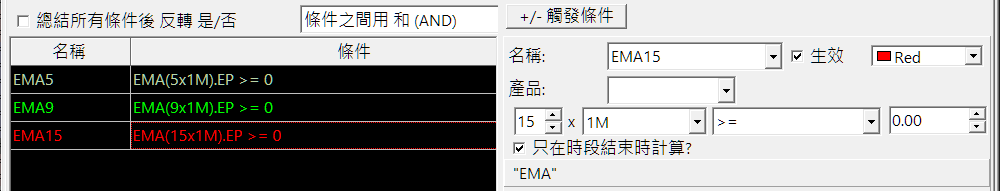

增加 一個 EMA的技術指標

更改參數. 再加多兩個EMA 條件

增加3個 不同的 EMA 指標

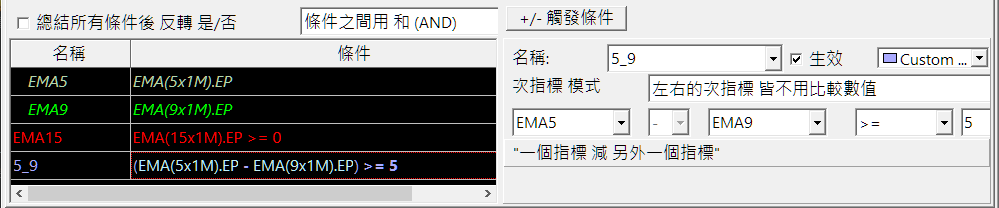

再在菜單加選 “一個指標 減 另外一個指標”

增加公式: 一個指標 減 另外一個指標

再 設定 EMA5 這個次指標 減 EMA9 這個次指標 要 大過等於 5, 並設定 EMA5 和 EMA9 這左右兩個次指都不用比較數值

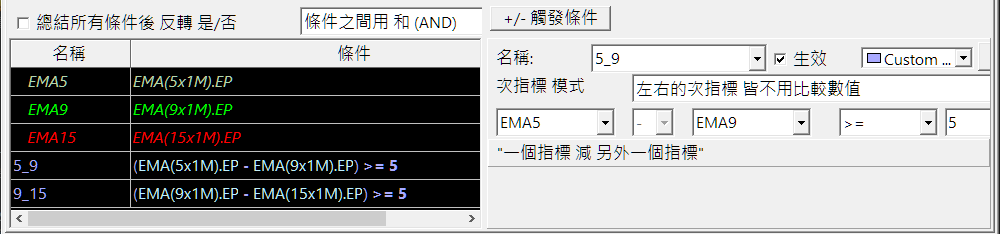

跟著再加選多一次 “一個指標 減 另外一個指標“, 類似的設定.

再加選 Slow Stochastic Oscillator, 設定它 >= 60

增加一個慢隨機指數(Slow Stochastics)

完成! 就是這麼簡單.

詳程請看視頻

按此下載高請視頻(102M)

按此觀看其他示範視頻 https://www.youtube.com/watch?v=bFEtnCTkHhc&list=PLyHhHLtfWiPoJIuDSJUMOyUetI9eyQoyJ

我們軟件功能眾多, 請用些時間瀏覽整個網站了解。

如欲索取一個月免費試用,請寄 電郵 給我們 。

或加我們 Whatsapp 3502 1457 或 LINE ID : spark-spapi

如你是期貨經紀, 歡迎連絡我們商討合作, 一起推廣程式交易給你的客戶.

Line ID : spark-spapi

這是我們的 Facebook page https://www.facebook.com/sparkapi 有最新的示範視頻. 請看看及分享給你的朋友